For much of the past century, federal and state taxes on gasoline and diesel have provided the majority of funding for US highway construction and maintenance. Fuel taxes perform well in this role: they distribute the tax burden among drivers in rough proportion to their use of the road network, are inexpensive to administer, and offer a modest incentive to buy and drive fuel-efficient vehicles.

Because the federal government and most states tax fuel on a cents-per-gallon basis, the tax rates must be periodically hiked to keep pace with inflation and increased fuel economy, a difficult political task in recent decades.

Because the federal government and most states tax fuel on a cents-per-gallon basis, the tax rates must be periodically hiked to keep pace with inflation and increased fuel economy, a difficult political task in recent decades. Consequently, fuel tax rates have stagnated, leading to reductions in real (inflation-adjusted) revenue per vehicle mile of travel (VMT).

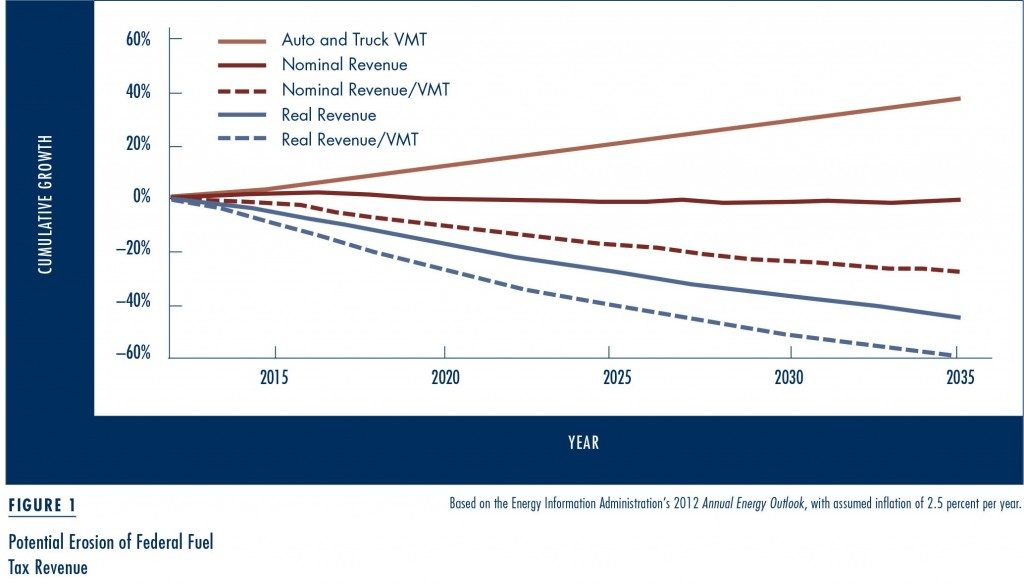

More stringent fuel economy standards and increased use of alternative fuels are expected to accelerate the erosion of fuel tax revenue in the coming years. Figure 1 traces the trajectory of federal fuel tax revenue if current tax rates, last increased in the early 1990s, are left unchanged through 2035. In short, nominal fuel tax revenue (unadjusted for inflation) will flatten, real fuel tax revenue will decline by over 40 percent, and real fuel tax revenue per VMT will decline by almost 60 percent.

This same concern applies to state fuel taxes. Together, federal and state fuel taxes currently provide around $70 billion in highway funding each year, accounting for about half of the nation’s budget for road expenditures. A 40 percent decline in real revenue thus translates to tens of billions of dollars per year.

The Allure of Mileage Fees

Current and projected revenue challenges have prompted growing interest in a transition from taxing fuel to taxing miles of travel. Mileage fees, also known as mileage-based user fees or VMT fees, promise more stable revenue than fuel taxes and allocate the tax burden in proportion to travel with greater precision. Tied to travel rather than fuel consumption, the revenue stream is immune to changes in fuel economy or even fuel type. Mileage fees must still be increased periodically to account for inflation, but the increases need not be as frequent or as large as with fuel taxes. Alternatively, mileage fees can be indexed for inflation when the program is first established.

Mileage fees, also known as mileage-based user fees or VMT fees, promise more stable revenue than fuel taxes and allocate the tax burden in proportion to travel with greater precision.

Fuel taxes can be indexed as well, though the indexing should account for both inflation and fuel economy improvements. With much more stringent federal fuel economy standards planned in the coming years, however, the distribution of the fuel-tax burden will become increasingly regressive; owners of newer vehicles with higher fuel economy will pay much less per mile, while owners of older and less efficient vehicles will pay more. The introduction of alternative fuels further complicates matters. Already, electric vehicles and natural gas vehicles can be recharged or refueled at home, and the same may be true of hydrogen fuel-cell vehicles at some point. Unless the fuel-tax collection regime can be extended to cover at-home refueling, a far more complicated task than collecting gasoline and diesel taxes at the wholesale level, such vehicles will be subject to no fuel taxes whatsoever.

In addition to more stable revenue and more precise allocation of the tax burden in proportion to travel, a mileage-fee system can be designed to provide a range of compelling advantages.

Value-added motorist services. One option for implementing mileage fees involves the use of in-vehicle devices with GPS and wireless communications. This equipment can also host a range of apps offering drivers greater convenience, safety, and opportunities to save money. Obvious examples include pay-as-you-drive insurance, automated payment of parking fees and tolls, real-time routing assistance, and alerts to safety hazards.

Better data for planning and operations. A system of mileage fees can also generate a steady stream of detailed (and anonymized) travel data, including traffic volumes and speed across all links of the network. Transportation departments can use these data to manage the transportation system in real time and to allocate additional investments where they are most needed.

Greater efficiency. Per-mile fees can be structured to vary according to time, location, and vehicle emissions class and weight, incentivizing travel decisions and vehicle choices that reduce traffic congestion, air pollution, and excessive road wear. For many observers, this represents the most persuasive argument for shifting to mileage fees. One form of variable fees—congestion pricing—has proven highly effective at reducing congestion. At present, however, congestion pricing applications involve significant technology development efforts and are limited to specific facilities or to small urban cores surrounded by a cordon ring of enforcement gantries. Under a mileage-fee system, with no additional expense, congestion pricing can be easily extended to cover all congested routes within a region, with the per-mile price potentially varying by both time and specific route to optimize overall traffic flow.

Under a mileage-fee system, with no additional expense, congestion pricing can be easily extended to cover all congested routes within a region, with the per-mile price potentially varying by both time and specific route to optimize overall traffic flow.

That said, the ability to implement congestion pricing, or any other form of variable fee, is not generally viewed as a selling point for building public acceptance. Most planning efforts have therefore assumed that a mileage-fee system will begin with a flat per-mile rate. Once the system is in place, local jurisdictions will then have the option of altering the fee structure to implement various forms of congestion tolls or other forms of pricing.

Other revenue mechanisms such as sales taxes, general fund transfers, fuel tax increases, or facility tolls are also viable for increasing funding for transportation. Only mileage fees, however, offer all of the benefits outlined above.

Increasing Interest in Mileage Fees

Mileage fees have attracted great interest abroad, leading to studies, trials, and fully implemented programs. Several European countries have established weight-distance tolls for commercial trucks, a variation on mileage fees that incorporates truck weight or axle weight in the fee structure. New Zealand instituted mileage fees for diesel-fueled trucks and passenger cars. The Netherlands conducted extensive planning for a kilometer-based road use charge that would apply to all vehicles, though a change in government stalled implementation.

Though mileage fees have yet to be implemented in the United States, interest is accelerating. Trials have been conducted in Oregon, Minnesota, and the Puget Sound region, while the University of Iowa staged trials involving participants in 12 cities across the country. Colorado, Nevada, Texas, Washington, and member states in the I-95 Corridor Coalition have studied the concept or are considering their own trials. New York City’s planned DriveSmart initiative envisions the deployment of sophisticated in-vehicle equipment that would initially focus on value-added services and could later be used to levy mileage fees. Oregon and New York have also conducted trials or studies looking at the automation of existing weight-distance truck tolls.

Just as Oregon was the first state to levy motor fuel taxes to fund highways in the early 20th century, it is now poised to lead the nation in implementing mileage fees. The Oregon Department of Transportation recently tested a fully-functional mileage-fee system in late 2012. Based on the results, state legislators passed legislation in the summer of 2013 that will allow up to 5,000 Oregon drivers, on a voluntary basis, to pay a 1.5 cents per-mile fee in place of the state’s 30 cents per-gallon fuel tax beginning in 2015. If successful, the switch to mileage fees may eventually become mandatory for all vehicles.

Lessons from the Front Lines

Programs in Europe and New Zealand demonstrate the technical feasibility of mileage-based taxation. Evidence from these programs suggests that drivers will modify their travel choices in response to the incentives in the per-mile pricing structure. In the German TollCollect program, for example, the newest and least polluting trucks qualify for a 50 percent discount on the per-kilometer rate. This has led to an extremely rapid turnover among truck fleets.

Programs in Europe and New Zealand demonstrate the technical feasibility of mileage-based taxation. Evidence from these programs suggests that drivers will modify their travel choices in response to the incentives in the per-mile pricing structure. In the German TollCollect program, for example, the newest and least polluting trucks qualify for a 50 percent discount on the per-kilometer rate. This has led to an extremely rapid turnover among truck fleets.

At the same time, experience from recent US trials make it clear that mileage fees involve a range of challenges and uncertainties:

System requirements. Policymakers must decide what functions mileage fee systems should support, such as varying fees by location and time of travel, providing value added motorist services, or offering various forms of privacy protection.

Technical design. A mileage-fee system must provide mechanisms to meter mileage, collect fees, prevent evasion, and protect privacy. There are numerous technical design options, each with different functionalities, levels of privacy protection, and costs of implementation and administration. For example, mileage fees based on annual odometer readings eliminate the cost of in-vehicle equipment and reduce privacy concerns, but might entail higher labor costs to conduct the readings. Mileage fees based on sophisticated in-vehicle equipment can enable location-based mobility apps, but may engender privacy concerns and increase the system’s capital costs. If different states choose different technical options, the systems should be interoperable—that is, able to collect and apportion fees for interstate travel.

Institutional structure. Appropriate institutional roles for government agencies and the private sector also need to be defined. Should the private sector be viewed solely as the source for technology procurement or should it also have a role in managing accounts and collecting revenue on behalf of the government?

The Core Challenges of Cost and Public Acceptance

Many of the issues and uncertainties above can be resolved with thoughtful planning and engineering. Two fundamental obstacles, however, bring into question the wisdom and viability of replacing fuel taxes with mileage fees: cost and public acceptance.

Many of the issues and uncertainties above can be resolved with thoughtful planning and engineering. Two fundamental obstacles, however, bring into question the wisdom and viability of replacing fuel taxes with mileage fees: cost and public acceptance.

Fuel taxes are collected from fewer than 2,000 fuel wholesalers around the country and passed along to consumers in the retail price of gasoline and diesel.

Fuel taxes are collected from fewer than 2,000 fuel wholesalers around the country and passed along to consumers in the retail price of gasoline and diesel. They are cheap to administer, typically costing about 1 percent of revenue. Mileage fees, by contrast, involve collecting taxes from millions of drivers, a much more complicated endeavor. This raises a legitimate concern that the advantages of mileage fees will be outweighed by the increased cost of collecting them. Recent evidence and modeling suggests that costs as a share of revenue could be around 5 or 6 percent, though earlier estimates have been even higher. Yet even with higher administrative costs, mileage fees are likely to yield far more net revenue over the coming decades than fuel taxes, given shifts toward higher fuel economy and alternative fuels.

Polls, however, indicate that current support for the concept of mileage fees is dismal. In fairness, other revenue options such as increasing fuel taxes also poll poorly. But mileage fees pose additional public acceptance challenges, such as fears of privacy invasion and low public trust in government.

When people hear about mileage fees, especially in conjunction with GPS-based metering, many think, “The government will be able to track where and when I drive, and I don’t like it.” New taxes and fees of any type are always a difficult political sell and it will be critical to assure the public that mileage-metering devices will be fair and secure.

Addressing Public Concerns

Planners and elected officials interested in mileage fees are well aware of the significant hurdles posed by high system costs and low public support, and have responded with considerable ingenuity. Earlier trials focused on demonstrating the technical feasibility of alternate mileage-fee implementation mechanisms. More recent efforts, in contrast, have explored innovative strategies aimed at overcoming cost and public acceptance challenges. Taking stock of recent trials and initiatives in the US, several broad themes emerge.

Proactively building support. Support for mileage fees appears to rise with greater familiarity and understanding. In the University of Iowa trials, the share of participants who viewed mileage fees favorably increased from 40 percent before the trials to 70 percent afterwards. Recent polling by the Mineta Transportation Institute indicates that support for mileage fees also increases when voters understand how the revenue will be allocated.

Proactively building support. Support for mileage fees appears to rise with greater familiarity and understanding. In the University of Iowa trials, the share of participants who viewed mileage fees favorably increased from 40 percent before the trials to 70 percent afterwards. Recent polling by the Mineta Transportation Institute indicates that support for mileage fees also increases when voters understand how the revenue will be allocated.

Building on the recognition that greater familiarity with mileage fees often translates to greater support, both Oregon and Minnesota included elected officials as participants in their recent mileage-fee trials. Another way to build support is to convene a diverse stakeholder taskforce to identify concerns and provide input on design principles and policy decisions. Minnesota, for example, included a member of the American Civil Liberties Union on its exploratory mileage-fee taskforce to help ensure that privacy concerns are properly addressed.

Providing drivers with choices. Recognizing that personal preferences vary, mileage-fee planners in Oregon have designed the system to allow drivers to choose among different options for metering mileage, paying fees, and protecting privacy. Drivers with strong privacy concerns, for example, can opt for a simple metering device that tallies only total mileage.

For those who remain steadfastly opposed to mileage fees, however metered, Oregon plans to provide drivers with an additional option of paying a fixed annual fee instead of paying by the mile.

Other drivers may prefer a GPS-equipped device that supports a greater range of value-added services and exempts fees for miles traveled out of state or on private roads. For those who remain steadfastly opposed to mileage fees, however metered, Oregon plans to provide drivers with an additional option of paying a fixed annual fee instead of paying by the mile. To avoid adverse selection, the fixed fee assumes high annual mileage. The Minnesota trials also provided participants with the option of metering total miles based on odometer readings or miles by time and location using a GPS-equipped smartphone app. Drivers using the smartphone app qualified for discounts on the per-mile fees for travel in rural areas or during off-peak hours, and paid no fees for out-of-state travel.

Fostering private sector competition and ingenuity. There are also several potential advantages to designing a system under which multiple firms are licensed to collect fees and provide metering devices. Much like smart phones, in-vehicle metering devices can support a range of mobility apps. Some of these, such as pay-as-you-drive insurance or automated parking fee payment, create additional revenue flowing through the system. Competition among firms can drive down costs and stimulate innovation in value-added services, while the revenue from additional paid services will reduce the cost borne by the public sector for collecting mileage fees.

Because many firms already provide in-vehicle equipment that offers all manner of motorist services, it isn’t necessary to reinvent the wheel. Oregon has developed open standards so that firms can modify existing devices and have them certified for metering and assessing mileage fees.

Starting small. Switching from fuel taxes to mileage fees will be enormously challenging, so recent planning efforts have started small and moved slowly. Oregon, for example, initially planned to levy mileage fees for any vehicle rated at 55 miles per gallon equivalent or higher, most of which are battery and plug-in hybrid vehicles. Texas also considered legislation to levy mileage fees on electric vehicles. Based on focus-group research, the notion that all drivers should pay their fair share resonates, and there aren’t enough electric vehicle owners to mount strong opposition. Some are concerned that this approach will slow sales of electric vehicles, but current government tax credits and subsidies for electric vehicle purchases greatly exceed what one might expect to pay in mileage fees.

Another approach is to establish a system in which drivers can voluntarily switch to mileage fees. The intent, however, is not to increase revenue in the near term; rather, it is to demonstrate through the engagement of willing drivers that the system works before transitioning to mileage fees for all vehicles. Oregon adopted this approach, and New York City’s planned DriveSmart initiative embodies this concept as well.

Developing a multi-jurisdictional system. A final idea being pursued in Oregon, and also explored by the I-95 Corridor coalition and in the University of Iowa trials, is to create a system that can accommodate multi-jurisdictional mileage fees. This enables either a multi-state or a national system, and it also allows localities to levy their own fees on top of state or federal fees. The net effect is to apportion fixed system costs across a larger number of drivers and increase total revenue flowing through the system, in turn reducing administrative costs as a share of revenue.

What Comes Next?

With the shortfalls in transportation funding, the success of distance-based road pricing in other countries, and the advances in supporting technologies, future prospects for mileage fees are surely greater than what current public opinion polls suggest.

The prospect of a broad transition to mileage fees in the United States remains uncertain. Many of the efforts described here are still ongoing, and it is too early to evaluate their cost and effectiveness. As fuel tax revenue continues to decline, however, interest in a more stable source of highway funding is increasing. With the shortfalls in transportation funding, the success of distance-based road pricing in other countries, and the advances in supporting technologies, future prospects for mileage fees are surely greater than what current public opinion polls suggest.

This article is adapted from Mileage-Based User Fees for Transportation Funding: A Primer for State and Local Decisionmakers, originally published by the RAND Corporation.

Further Readings

Congressional Budget Office. 2011. Alternative Approaches to Funding Highways, Publication No. 4090, Washington, DC: The Congress of the United States.

Paul Sorensen, Liisa Ecola, and Martin Wachs. 2012. Mileage-Based User Fees for Transportation Funding: A Primer for State and Local Decisionmakers, Santa Monica: RAND Corporation.

Paul Sorensen, Martin Wachs, and Liisa Ecola. 2010. System Trials to Demonstrate Mileage-Based Road Use Charges, Washington, DC: National Cooperative Highway Research Program, Transportation Research Board.

US Government Accountability Office. 2012. Highway Trust Fund: Pilot Program Could Help Determine the Viability of Mileage Fees for Certain Vehicles, Report GAO-13-77.

US National Surface TransportationInfrastructure Financing Commission. 2009. Paying Our Way: A New Framework for Transportation Finance.