Reducing US gasoline consumption might seem a straightforward task: just increase vehicle fuel efficiency, also known as miles per gallon (MPG). That, of course, is the principle behind the existing Corporate Average Fuel Economy (CAFE) standards.

Reducing US gasoline consumption might seem a straightforward task: just increase vehicle fuel efficiency, also known as miles per gallon (MPG). That, of course, is the principle behind the existing Corporate Average Fuel Economy (CAFE) standards.

But it’s not that simple. If MPG improves, the cost to drive a mile declines, so people drive more. Some critics have even argued that this “rebound” effect is so large that not much gasoline is saved, and other problems such as congestion are exacerbated. Is this right?

Our research measures the size of the rebound effect and discovers that it is not large. Moreover, we find that it has become smaller over time, and is likely to become smaller still. This means that improved fuel efficiency does translate into lower fuel consumption. Our results also have implications for the policy choice between CAFE standards and fuel taxes as ways to reduce energy consumption. This is easiest to understand by relating the rebound effect to a slightly different question: how do drivers respond to changes in fuel prices?

Fuel Costs, Fuel Efficiency, And Driver Response

Drivers respond to an increase in fuel prices in several ways. The most important are: reducing travel, and buying more fuel-efficient vehicles.

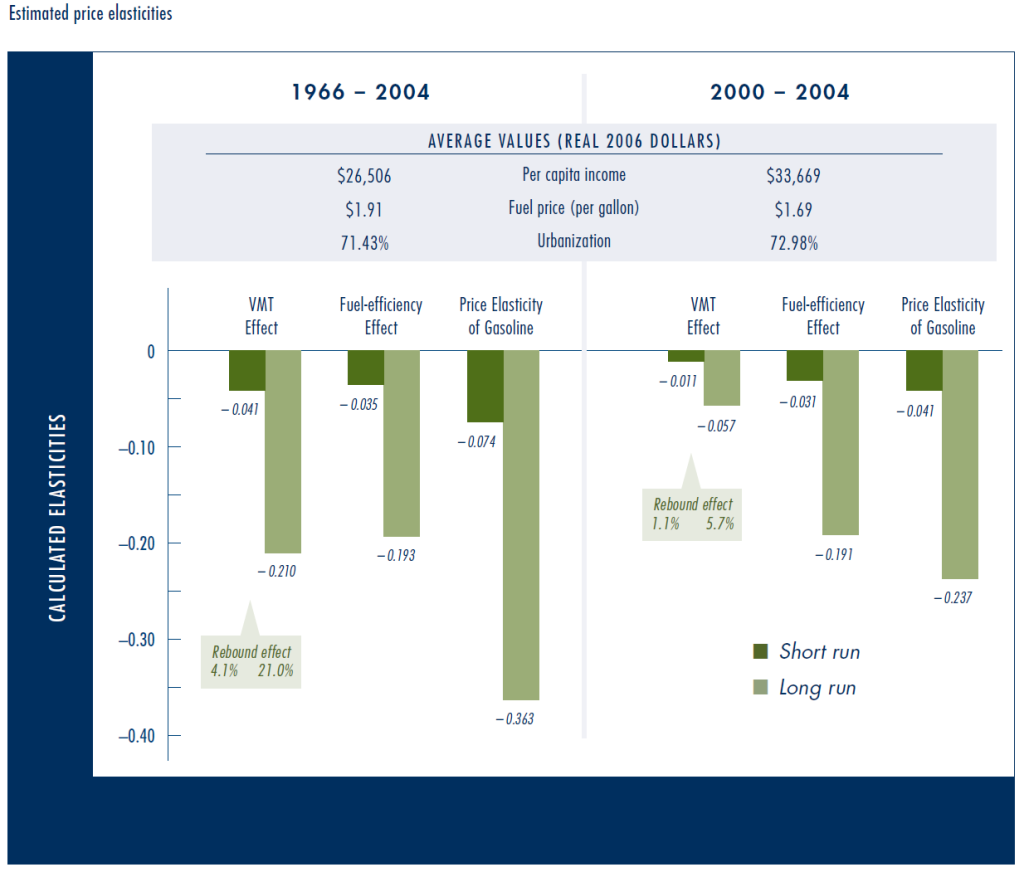

First, consider the effect on vehicle miles traveled (VMT). As fuel prices rise, drivers reduce VMT in order to save fuel. We measure the size of this “VMT effect” as an “elasticity”: the percentage change in VMT divided by the percentage increase in fuel prices. For example, if a 100 percent increase in price causes a 20 percent decline in VMT, the elasticity is -0.2.

How is this VMT effect related to the rebound effect? Both measure how drivers react to a change in the fuel costs of driving—in one case due to a change in fuel prices, in the other case due to a change in fuel efficiency (MPG). If drivers react the same way to either source of change in fuel costs—as is assumed by nearly all analysts—then numerically the elasticities are the same for both. By convention the rebound effect is expressed not as a fraction (like 0.2) but as the corresponding percentage (20 percent). A twenty percent rebound effect would wipe out twenty percent of the fuel savings that would otherwise result from any given improvement in fuel economy.

If the rebound effect is small—say ten to twenty percent—then CAFE standards will mainly work as hoped: eighty to ninety percent of the fuel savings made possible by changes in vehicle characteristics will be achieved. But if the rebound effect is large, say forty to sixty percent, then fuel economy mandates are less cost effective because too much of the hoped-for fuel savings is lost in extra travel. Plus, as already noted, this extra travel may cause other problems.

Second, consider the effect of rising fuel prices on the sales of high-MPG vehicles. This response can occur either through consumer or manufacturer decisions about technology and vehicle mix. As an example, sales of sport utility vehicles (SUVs) fell when gas prices skyrocketed in 2005 (a consumer response). At the same time, the competition to develop hybrid vehicles heated up (a manufacturer response, driven by consumer preferences). Together, we can call these responses the “fuel-efficiency effect” of a fuel-price increase. So to understand all the effects of fuel taxes (or of other measures that might raise fuel prices), we need to measure both the VMT effect and the fuel efficiency effect.

To recap: an increase in gasoline price produces both a VMT effect (fewer miles driven) and a fuel-efficiency effect (more efficient vehicles used). Together, the two effects determine the price elasticity of gasoline, that is, the reduction in consumption that occurs in response to an increase in price. If this price elasticity of gasoline is large (like -0.8), it means that consumers and manufacturers together respond strongly to higher prices, using less fuel. But if it is small (like -0.3), it means neither consumers nor manufacturers react much to fuel price changes, so a rather large hike in gasoline taxes would be required to achieve a given target for fuel-use reduction. That can present political and administrative problems that would make gas taxes a less attractive option.

To recap: an increase in gasoline price produces both a VMT effect (fewer miles driven) and a fuel-efficiency effect (more efficient vehicles used). Together, the two effects determine the price elasticity of gasoline, that is, the reduction in consumption that occurs in response to an increase in price. If this price elasticity of gasoline is large (like -0.8), it means that consumers and manufacturers together respond strongly to higher prices, using less fuel. But if it is small (like -0.3), it means neither consumers nor manufacturers react much to fuel price changes, so a rather large hike in gasoline taxes would be required to achieve a given target for fuel-use reduction. That can present political and administrative problems that would make gas taxes a less attractive option.

Measuring VMT And Fuel-Efficency Responses

So how big is the price elasticity of gasoline? There is reasonable consensus that, when measured over a decade or more to allow consumers time to replace vehicles with more efficient ones, it is around -0.5; that is, if the price of gasoline doubles, its consumption will fall by about half. But as we have just seen, the components of this elasticity also matter because they tell us whether higher prices cause less driving, more fuel-efficiency in vehicles, or both. Furthermore, there have been suggestions that the price elasticity of gasoline has decreased over the last few decades—that is, consumers have grown less responsive to price changes. If that’s true, which of its components has decreased?

Many studies have measured the VMT effect or, equivalently, the rebound effect. Most results for the rebound effect are in the range of five to twenty percent over a period of one year (“short run”), and twenty to thirty percent over many years (“long run”). Thus, for example, if CAFE-like standards succeed in doubling fleet-average fuel efficiency, in the long run people might end up driving twenty to thirty percent more. If these results are accurate, they mean that improvements in fuel economy are a fairly effective way of reducing fuel consumption.

We analyzed annual US data by state from 1966 through 2004, and here provide new empirical estimates of the price elasticity of gasoline and its components. (We recently reported similar numbers in an academic publication, but based on data only through 2001.) Because our data set is more comprehensive than that used in most studies, we are able to measure these effects with greater precision and, most importantly, to investigate whether they depend on factors that are changing over time.

We analyzed annual US data by state from 1966 through 2004, and here provide new empirical estimates of the price elasticity of gasoline and its components. (We recently reported similar numbers in an academic publication, but based on data only through 2001.) Because our data set is more comprehensive than that used in most studies, we are able to measure these effects with greater precision and, most importantly, to investigate whether they depend on factors that are changing over time.

In particular, we posit that the rebound effect should depend on both average per capita income and average fuel costs. First, it should decline as average income rises, because then time costs rather than fuel costs tend to become more important in deter- mining people’s travel decisions. Second, the rebound effect should rise as fuel costs rise, for the same reason in reverse: fuel costs then become a larger factor. We also posit that the rebound effect should decline with increasing urbanization because then the time costs of congestion tend to dominate the cost of driving, again relegating fuel costs to lesser importance in people’s decisions.

The fuel-efficiency effect is also in line with previous studies, as is the long-run price elasticity of gasoline. The latter means, for example, that a permanent increase of the fuel price from $2.50 to $3.50 in constant dollars (a forty percent increase) would reduce fuel consumption by some 14.5 percent in the long run (0.363 times 40), all else equal.

What is most important about our results is what happens when we compare the entire time period to just the last five years. We find that the VMT and rebound effects are affected by per capita income, fuel costs, and urbanization just in the manner we posited. The strongest influence is income, the second strongest is fuel costs. Because incomes rose but fuel costs per mile fell over this period, both sources of variation caused the rebound effect to decline. This decline is substantial: we calculate that over the last five years of the sample, the rebound effect was only about one-fourth as large as its average over the entire period. This means that fuel economy improvements are more effective at reducing fuel consumption now than they were in the past.

While the VMT effect (change in number of miles driven) was declining, the fuel-efficiency effect was changing very little. As a result, the magnitude of the price elasticity of gasoline declined, but only modestly (from -0.363 to -0.237 in the long run). Interestingly, a recent working paper by Jonathan Hughes, Christopher R. Knittel, and Daniel Sperling at UC Davis also finds a decline of the price elasticity over time, although using a quite different approach.

Because we isolate the factors causing this decline, we can also say something about future trends. Projections by the Energy Information Agency show per capita income continuing its steady rise, while gasoline prices are expected to be flat or possibly to rise slowly. (Both income and fuel price are here expressed in constant dollars.) Furthermore, the elasticities we measure are about four times more sensitive to income than to fuel costs; and even if gasoline prices rise further, fuel costs per mile probably won’t, because of improvements in fuel efficiency. Therefore, it seems to us extremely likely that the price elasticity of gasoline will continue to fall slowly, and that the rebound effect will decline to a very small value.

Policy Implications

Our results show that, assuming real incomes will continue their steady rise, the rebound effect will become less and less important as a component of the price elasticity of gasoline. Meanwhile, consumers and manufacturers continue to respond strongly to fuel prices by making changes in fuel efficiency.

Our results show that, assuming real incomes will continue their steady rise, the rebound effect will become less and less important as a component of the price elasticity of gasoline. Meanwhile, consumers and manufacturers continue to respond strongly to fuel prices by making changes in fuel efficiency.

These two predictions together—a sharply falling VMT effect but stable fuel- efficiency effect—tell us that government policies focused on either increasing vehicle fuel efficiency or increasing gas taxes can be effective, although in the latter case the increase in gas taxes would need to be quite large. But we should not expect energy policies to bring about much change in collateral problems of motor vehicles, such as congestion or air pollution, because changes in the amount of driving will be small. Those problems will remain whether or not we succeed in reducing the energy impacts of transportation, and solving them will require other measures.

Further Readings

David L. Greene, James R. Kahn, and Robert C. Gibson, “Fuel Economy Rebound Effect for US Households,” Energy Journal, vol. 20, no. 3, 1999.

Ian W. H. Parry and Kenneth A. Small, “Does Britain or the United States Have the Right Gasoline Tax?” American Economic Review, vol. 95, 2005.

Paul R. Portney, Ian W. H. Parry, Howard K. Gruenspecht, and Winston Harrington, “The Economics of Fuel Economy Standards,” Journal of Economic Perspectives, vol. 17, 2003.

Kenneth A. Small and Kurt Van Dender, “Fuel Efficiency and Motor Vehicle Travel: The Declining Rebound Effect,” Energy Journal, vol. 28, no. 1, 2007.