American politicians are bitterly divided on many matters of public policy, yet they seem to agree that spending on transportation programs creates jobs and thus constitutes a path out of the nation’s long and deep recession. Infrastructure investments are prescribed to stimulate the economy in the short term by creating construction employment, and to foster longer-term economic growth by making the transportation system more efficient and reliable. Democrats and Republicans, liberals and conservatives, rural and urban elected officials—all seek funding for roads and transit projects in their districts, asserting repeatedly that these expenditures will create jobs. President Obama vigorously sought to create jobs through transportation spending in the recent economic stimulus package. This seemed familiar: in 1991, when signing the historic Intermodal Surface Transportation Efficiency Act (ISTEA), President George H.W. Bush stated that the value of the bill “is summed up by three words: jobs, jobs, jobs.”

Infrastructure investments are prescribed to stimulate the economy in the short term by creating construction employment, and to foster longer-term economic growth by making the transportation system more efficient and reliable.

Are the politicians right? At this moment of challenge and opportunity, can wise national investments in infrastructure advance both short-term economic recovery and long-term economic well being? Rapid and sustained economic growth is a broadly shared goal, and efficient use of transportation dollars is critical when the nation is confronting growing deficits and persistent unemployment. Yet transportation projects are not all equally effective at creating jobs or stimulating economic growth. This article examines the relationships between transportation investments, short-term job creation, and longer-term economic growth.

How Transportation Creates Economic Growth

Sound transportation investments lower the costs of moving people and goods. This increases economic productivity, which roughly can be measured as the output of goods and services per dollar of private and public investment. And improved productivity leads to a higher standard of living. Because productivity is a central component of economic growth, it should be of major concern when assessing the value of transportation expenditures. It is important to focus on improving productivity even when policymakers strive to serve other important long-term transportation objectives, such as improving safety, energy independence, and environmental sustainability. High-productivity transportation investments increase connectivity and reduce congestion; by doing so they improve economic well-being. Short-term job creation, while vitally important to economic recovery, should not cause us to ignore the longer-term view.

High-productivity transportation investments increase connectivity and reduce congestion; by doing so they improve economic well-being.

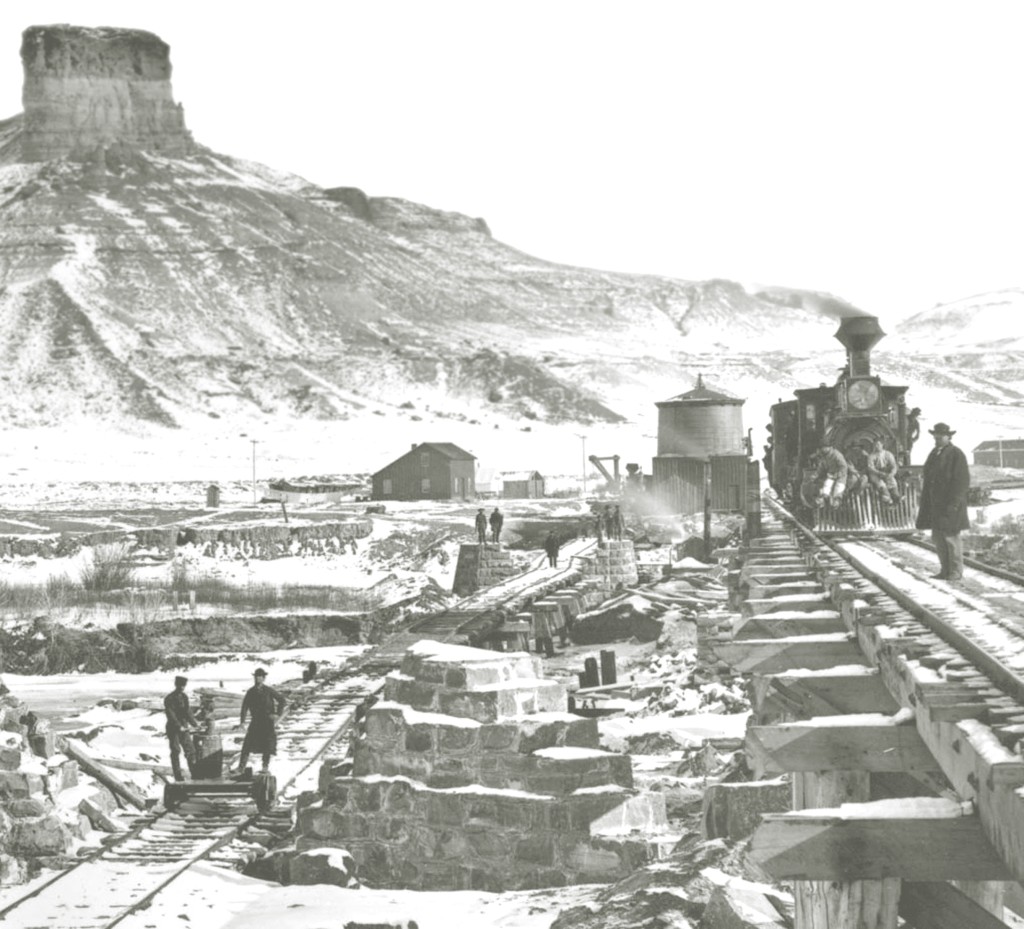

Building the Interstate Highway System created many construction jobs, but it would be a huge mistake to interpret that employment as the system’s contribution to the economy. Workers who drew salaries from the construction program benefitted, but far less than the travelers and shippers of goods who have used those facilities every day for six decades. On a smaller scale, while the Golden Gate and San Francisco-Oakland Bay Bridges were both built during the Great Depression in part to create jobs, their combined value to the Bay Area’s economy over eight decades clearly dwarfs the benefits from initial construction jobs.

One way to judge a public investment is to determine whether or not it generates a rate of return to society that exceeds the return earned on other investments in the private or public sectors. Resources for government transportation investments are ultimately drawn from citizens and businesses through taxes or fees (like tolls), or borrowing. Had these dollars not been collected for transportation investments, they would have been put to other uses. Thus, the dollars used for these public investments constitute foregone opportunities to earn returns through private investments in businesses, or public investments in other programs ranging from schools to national parks. To be worthwhile undertakings, transportation investments should demonstrate that they raise the standard of living in the future as much, or more than, alternative private or public sector uses of the funds. To ensure the best use of taxpayer dollars, responsible officials should choose those projects yielding the highest returns. Most often that means transportation dollars should be spent on programs that most enhance long-term economic productivity.

One way to judge a public investment is to determine whether or not it generates a rate of return to society that exceeds the return earned on other investments in the private or public sectors. Resources for government transportation investments are ultimately drawn from citizens and businesses through taxes or fees (like tolls), or borrowing. Had these dollars not been collected for transportation investments, they would have been put to other uses. Thus, the dollars used for these public investments constitute foregone opportunities to earn returns through private investments in businesses, or public investments in other programs ranging from schools to national parks. To be worthwhile undertakings, transportation investments should demonstrate that they raise the standard of living in the future as much, or more than, alternative private or public sector uses of the funds. To ensure the best use of taxpayer dollars, responsible officials should choose those projects yielding the highest returns. Most often that means transportation dollars should be spent on programs that most enhance long-term economic productivity.

Transportation Investments Often Redistribute Rather Than Create Growth

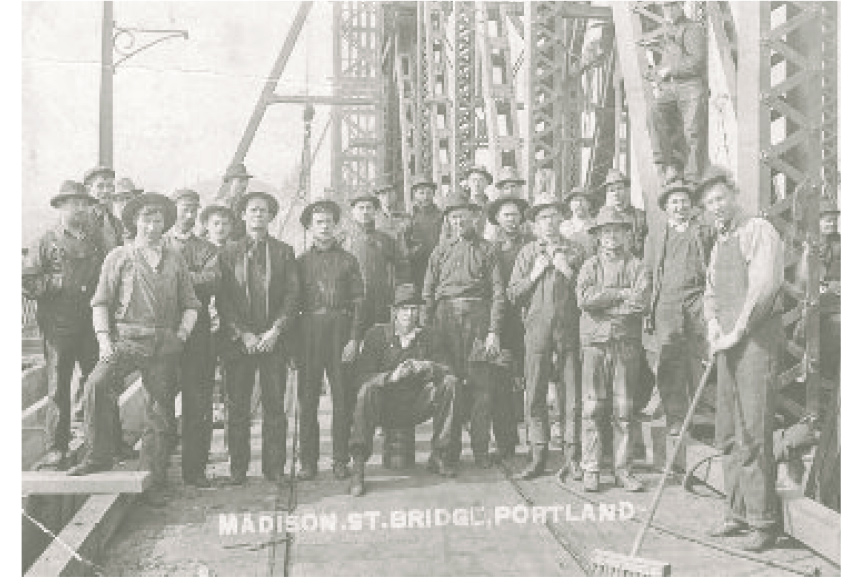

By building an effective transportation network, government transportation spending draws jobs to those industries that benefit from the investment. At the same time, this shift of resources moves jobs away from activities that would have been financed in the absence of the transportation investment. So while transportation investment can “create jobs,” it can also destroy them. The overall effect is positive only when it creates more and better jobs, or more and better economic activity, than it eliminates.

While transportation investment can “create jobs,” it can also destroy them.

Determining whether a project’s effects are going to be positive or negative can be difficult. A transportation investment might shift jobs, not just across industries and sectors, but also across counties and states. Even a transportation investment that destroys more jobs than it creates can look good, especially in the short term, from the perspective of the winning state or city. Gains and losses might be unevenly distributed, temporally as well as spatially. For example, building an ill-advised rail line might give a local economy a short-term boost in employment, only to saddle taxpayers with large operating deficits in the future.

From a national perspective, and over time, gains that are immediate and obvious can be—and often are—outweighed by diffuse losses elsewhere. Suppose federal money was used to build a new highway link between a port and freight rail hub. The new link might cut delivery time within the region. The prospect of improved inventory management, increased sales, and other sources of profit would draw cargo to that port, increase port jobs, expand employment related to regional highway goods movement, and increase business at the rail hub. At the same time, it would likely reduce traffic to competing ports in other regions and create exactly the same chain reaction—in reverse—in those other areas. Employment would be lost as business is attracted to the competing port. The economy as a whole would be better off only if the increased productivity in the target area exceeded the cost of the highway investment and the loss of business in competing regions.

From a national perspective, and over time, gains that are immediate and obvious can be—and often are—outweighed by diffuse losses elsewhere. Suppose federal money was used to build a new highway link between a port and freight rail hub. The new link might cut delivery time within the region. The prospect of improved inventory management, increased sales, and other sources of profit would draw cargo to that port, increase port jobs, expand employment related to regional highway goods movement, and increase business at the rail hub. At the same time, it would likely reduce traffic to competing ports in other regions and create exactly the same chain reaction—in reverse—in those other areas. Employment would be lost as business is attracted to the competing port. The economy as a whole would be better off only if the increased productivity in the target area exceeded the cost of the highway investment and the loss of business in competing regions.

Not all transportation investments meet these criteria. In the example above, suppose the highway link was built not at the high-productivity port, but instead, because of political considerations, in a region that has a less-busy port with little congestion. While more people in the less-productive region are employed in the construction of the facility, people in the more-productive region are likely to lose jobs, and the overall effect is likely to be negative. That is precisely why a “bridge to nowhere” in one particular state is a poor national investment even though it may benefit construction workers and others where it is built. In Los Angeles, the Alameda Corridor freight rail project greatly improved connectivity between the ports and the ground freight shipment system, but some of its benefits must be offset by calculating the growth that it redirected away from other ports such as Seattle or Oakland, given that shipping is a highly competitive economic sector.

A “bridge to nowhere” in one particular state is a poor national investment even though it may benefit construction workers and others where it is built.

The Interstate Highway System, the nation’s greatest transportation investment project, created jobs near interchanges when new businesses took advantage of the improved accessibility. At the same time, other towns that were bypassed “died on the vine.” Most analysts and lay citizens believe that, overall, the gains exceeded the losses by an enormous margin, and thus that the Interstate System was justified as a national investment. But not every city, road, or interchange benefited equally.

Transportation Spending and the Multiplier Effect

When advocating federal spending on transportation projects that will benefit their jurisdictions, public officials often mention that each billion dollars of transportation infrastructure investment will create over 30,000 new jobs. This estimate relies on what is called the “multiplier effect.” When money is spent on any public works project, the people who are paid to construct that project use the money they receive to buy services and goods from others. The money spent in any jurisdiction thus recirculates there and elsewhere, with the initial expenditure priming the pump of economic activity. Construction workers spend their income to buy hamburgers, television sets, and automobile insurance, so a given dollar of construction expenditure ends up having more than a dollar’s worth of impact, thus “multiplying” the effect of the expenditure.

Unfortunately, asserting that any expenditure will create a specific number of jobs is not well supported by evidence. There are two problems with coarse estimates of the number of jobs that transportation spending will create. The first is that the number used is a gross estimate based on generalized mathematical models, and such estimates could be far off for any particular expenditure. Actual employment impacts vary dramatically from one project to another, even when focusing on short-term construction-related jobs. The second and more important problem is that, while short-term job creation is desperately sought during a deep recession, such crude estimates of job creation do not address the longer term economic impacts discussed earlier.

Unfortunately, asserting that any expenditure will create a specific number of jobs is not well supported by evidence. There are two problems with coarse estimates of the number of jobs that transportation spending will create. The first is that the number used is a gross estimate based on generalized mathematical models, and such estimates could be far off for any particular expenditure. Actual employment impacts vary dramatically from one project to another, even when focusing on short-term construction-related jobs. The second and more important problem is that, while short-term job creation is desperately sought during a deep recession, such crude estimates of job creation do not address the longer term economic impacts discussed earlier.

Transportation policy can have significant and lasting impacts on overall economic growth by promoting improved productivity, which in turn creates higher-paying jobs across the entire economy. But, in the short term, construction jobs and expenditures on steel and concrete are actually economic costs rather than benefits unless they contribute to long-term economic productivity. Proposals to invest money in surface transportation for the primary purpose of job creation present the nation with the serious risk that we will quickly build projects that will not necessarily grow the economy. There is no reason to believe that spending money on transportation projects creates more jobs in the short run than would spending money in other important economic sectors, like education and health care. We must also judge the social value of those projects in terms of their longer-term impacts on economic efficiency. If we rush to spend money in the hope that we can literally dig our way out of recession, well-intended spending on transportation for the purposes of job creation could fund investments that, in many cases, cost the economy far more in the longer term than they help it in the short term.

Balancing Long-Term Economic Growth and Short-Term Job Creation

Ideally, well-chosen transportation investments can advance both long-term productivity growth and short-term job creation. If possible, governments should choose projects that are beneficial from a productivity perspective and also happen quickly enough to move the economy back toward full employment. A high-productivity investment that can be started quickly can produce a clear “win-win” outcome for the economy: The economy recovers more quickly and long-run productivity is enhanced. So, for example, building a high-speed freight highway to connect a congested port to a rail hub during a recession could be an excellent investment. It already offers a net benefit overall, and the construction jobs provide added benefits to society even though they are actually a cost to the project.

On the other hand, identifying a project as shovel-ready in no way assures that it will produce long-term net economic benefits. Likewise, a high-productivity investment may not be shovel-ready, and, despite great social value, it may not add short-term jobs. In practice, the long lags associated with environmental reviews, permitting, engineering design, site acquisition, and so forth have traditionally hampered the use of public works projects as an anti-recession policy.

To create or preserve jobs in the short term, it might be more effective to use federal dollars to subsidize the operations and maintenance of transportation systems. Dollars spent on operating bus lines, for example, are spent largely on labor and thus quickly recirculate in the local economy. By contrast, dollars spent on capital or construction projects may include costly expenditures on concrete and steel imported from outside the US. However, statutes and regulations limit the use of federal funds to cover operating and maintenance costs. These limitations stem from the belief that operating subsidies discourage efficiency by inviting those who operate the systems to rely on the subsidies instead of cutting their costs or increasing their revenues from tolls or fares.

These are legitimate concerns, yet it is inconsistent to recognize the goal of promoting efficiency when it comes to operations but to ignore it when spending money on “shovel ready” projects. And operating expenditures might be better than capital investments in both the short and long terms. Construction jobs do not inherently have higher multipliers than jobs driving buses, especially when bus routes are being curtailed to cope with deficits during a recession. Also, spending on operations might produce greater economic productivity benefits than capital projects. In the end, the economic productivity of alternative expenditures depends more on what is being built and which services are being offered, rather than on the number of jobs immediately saved or created. Yet this question is rarely asked and job creation remains the focus of political attention. During a recession, it might, in some cases, be appropriate to set aside limitations on operating subsidies rather than to fund capital investments that produce neither short-term jobs nor long-term economic growth. Doing so would more honestly amount to a “jobs” program than an economic growth program, and might have greater long-term benefits as well.

These are legitimate concerns, yet it is inconsistent to recognize the goal of promoting efficiency when it comes to operations but to ignore it when spending money on “shovel ready” projects. And operating expenditures might be better than capital investments in both the short and long terms. Construction jobs do not inherently have higher multipliers than jobs driving buses, especially when bus routes are being curtailed to cope with deficits during a recession. Also, spending on operations might produce greater economic productivity benefits than capital projects. In the end, the economic productivity of alternative expenditures depends more on what is being built and which services are being offered, rather than on the number of jobs immediately saved or created. Yet this question is rarely asked and job creation remains the focus of political attention. During a recession, it might, in some cases, be appropriate to set aside limitations on operating subsidies rather than to fund capital investments that produce neither short-term jobs nor long-term economic growth. Doing so would more honestly amount to a “jobs” program than an economic growth program, and might have greater long-term benefits as well.

In the end, the economic productivity of alternative expenditures depends more on what is being built and which services are being offered, rather than on the number of jobs immediately saved or created.

The perceived need to create jobs has spurred the Obama Administration and Congress to authorize $35 billion in general fund transfers to the Highway Trust Fund and an additional $27 billion through the American Recovery and Reinvestment Act (ARRA) to increase transportation spending. This means that the nation has increased its growing deficits to finance transportation projects in the hope of producing jobs in the short run, even though much of that spending could fail to contribute to longer-term economic growth. Moreover, in the past, spending on other worthy transportation projects to increase long-term economic productivity has proven to be too slow in getting started to alleviate unemployment in the short term. Thus, it is likely that some new spending will not be successful either at stimulating short-term employment or at creating long-term economic growth. Simply equating any transportation investment with jobs and gains for the economy cannot remain a sound basis for public policy. America needs to do a better job of systematically evaluating alternative investments so that we increase the returns from what are increasingly scarce funds available for transportation.

Further Readings

James Heintz, Robert Pollin and Heidi Garrett-Peltier. 2009. “How Infrastructure Investments Support the U.S. Economy: Employment, Productivity and Growth,” Political Economy Research Institute and Alliance for American Manufacturing.

Douglas Holtz-Eakin and Martin Wachs. 2011. “Strengthening Connections between Transportation Investments and Economic Growth,” Bipartisan Policy Center.

Brian Taylor and Kelly Samples. 2002. “Jobs, Jobs, Jobs: Political Perceptions, Economic Reality, and Capital Bias in US Transit Subsidy Policy,” Public Works Management and Policy, 6 (4): 250-263.