The California economy is in the doldrums, especially in the Los Angeles region, owing in large part to the decline of aerospace-defense industries. The region also suffers from the nation’s worst pollution problem, owing largely to its dependence on automobiles. So, we’re led to ask whether these linked perils might be converted into a combined opportunity. We ask whether we might blunt both the environmental and the employment problems by building a new electric-vehicle industry in Southern California that exploits its skilled but underemployed labor and managerial resources and creates a transportation system that doesn’t pollute.

In a study we conducted two years ago1, researchers projected a new electric-vehicle industry in the United States, focused on both final assembly and components manufacturing. The study predicted that the industry will at first be small in scale, serving rapidly shifting niche markets instead of achieving large-scale mass production. Therefore, the pioneer companies will need to adopt highly flexible production technologies and adaptive organizational forms. The industry will comprise many different subcontractors and.specialized suppliers in a dense network with little vertical integration. That is, one company will not manufacture an entire vehicle on its own. Instead, many specialized companies will contribute to the finished product, and significant parts of the industry will concentrate in the same geographical area.

But where will the main concentrations of production be located and within what institutional frameworks? The industry could very well develop in either Japan or Europe under the aggressive industrial policies that prevail in those two places, or in the Northeast of the United States where domestic car producers are now planning manufacturing systems to beat the Japanese and European competition. General Motors has plans to manufacture an electric passenger car, the Impact, at its Reatta plant in East Lansing, Michigan; however, the Impact project is now reported to be considerably delayed. Given the head start Japan, Europe, and the U.S. Northeast have on automobile manufacturing, why would Southern California be a likely world center for producing electric cars?

But where will the main concentrations of production be located and within what institutional frameworks? The industry could very well develop in either Japan or Europe under the aggressive industrial policies that prevail in those two places, or in the Northeast of the United States where domestic car producers are now planning manufacturing systems to beat the Japanese and European competition. General Motors has plans to manufacture an electric passenger car, the Impact, at its Reatta plant in East Lansing, Michigan; however, the Impact project is now reported to be considerably delayed. Given the head start Japan, Europe, and the U.S. Northeast have on automobile manufacturing, why would Southern California be a likely world center for producing electric cars?

It’s a mistake to assume that manufacturing electric cars will require similar processes and equipment as for manufacturing conventional cars. On the contrary: by one estimate, 40 percent of the components and subsystems in an electric vehicle must be different from those of a gasoline vehicle, and another 30 percent should be different.2 So, it might be easier to develop an electric-car industry from scratch than to reshape the gasoline-car industry. If so, then Southern California is a likely place to start.

CALIFORNIA’S LEAD

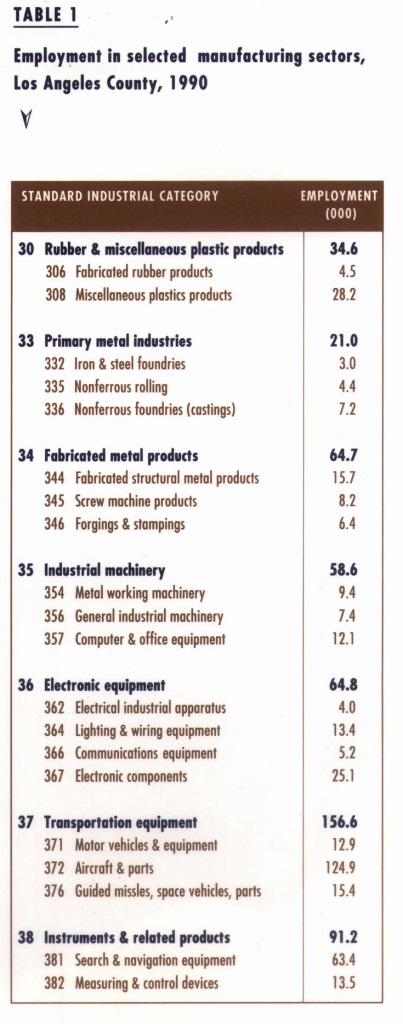

The economic and human resources for an electric-car industry are already in place in Southern California. Los Angeles has an enormous aerospace industrial complex that could be used to produce electric-car parts. Particularly important are the numerous plastics molding firms, foundries, machine shops, tool and die manufacturers, and electronic- components producers. (See Table 1.) Engineering, technical, and skilled craft labor abounds.

On the political front, local groups have been advocating development of an electric- vehicle industry. A powerful coalition has formed joining those committed to reducing air pollution in the Los Angeles Basin with those concerned about the region’s faltering economy. The movement is propelled by politicians at all levels of government, powerful local agencies, lobbying groups, large corporations, labor unions, and academic institutions.

Already the new industry is taking root. In 1989 the Los Angeles City Council adopted an initiative to sponsor production of at least 5,000 electric passenger cars and 5,000 electric vans by 1995. Eighteen companies responded to the initiative. The city selected a Swedish-British venture named Clean Air Transport to produce a hybrid gasoline electric car (the IA 301) with $7 million in financing from the city’s Department of Water and Power. However, the company has been unable to raise matching funds from private sources.

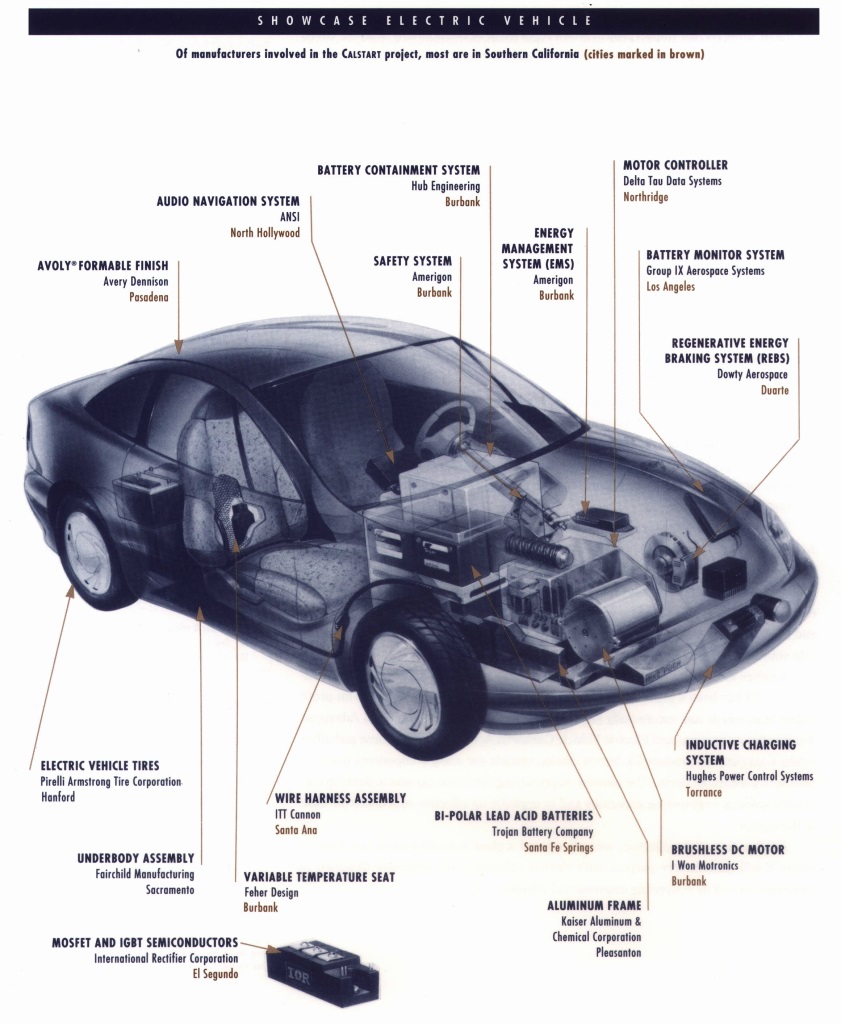

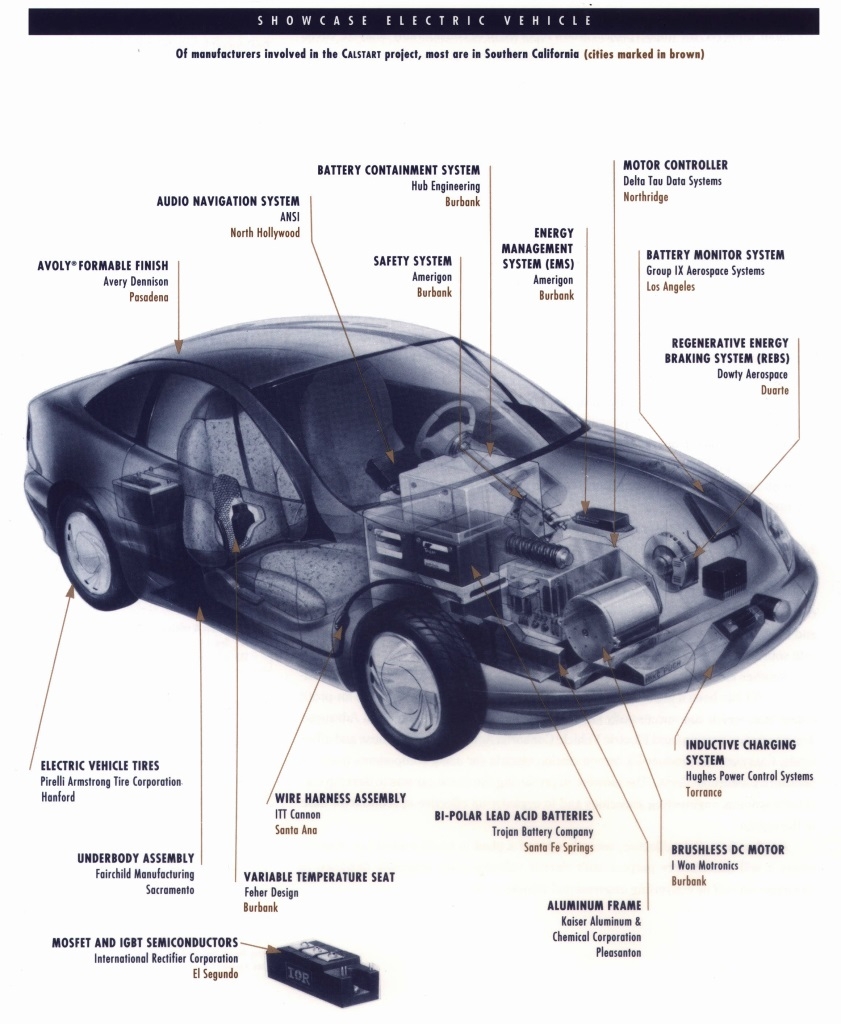

Another electric-car manufacturing venture in the region is Amerigon. The company’s CEO has been a prime mover in the formation of CALSTART, a local not-for-profit consortium which has successfully raised public funds through the federal Advanced Transportation Systems and Electric Vehicle Consortia Act of 1991. With these and other funds, CALSTART has produced a demonstration electric car using components made by Southern Californian firms. The purpose of producing the demo car was to develop CALSTART’s systems engineering capacities and to organize an effective subcontractor base in the region.

Another firm, Solar Electric, recently opened a plant in south-central Los Angeles where it will manufacture purpose-built electric vehicles-cars originally designed as electrics-as well as converting conventional vehicles.

The 491,000 workers currently employed in these sectors, along with the technology, can undoubtedly be reoriented to the needs of electric-vehicle production. One major problem, of course, is that some of these sectors are dominated by defense contractors, who will have to change their cost-plus, quality-at-any-price habits. They will have to convert to forms of manufacturing more suited to the competitive pressures of civilian markets.

Although these pioneer firms may ultimately fail (the risks they face are enormous), the organizational patterns, knowhow, and political support they generate in Southern California will surely pave the way for future local efforts in electric-vehicle development and production. Further legislation is expected to make gasoline powered cars more expensive to operate, increasing the attractiveness of electric vehicles. Thus, if collective efforts can be intensified, a new and growing industrial complex can be expected to take shape over the next several years. And with an early start, Southern California stands a good chance of beating the competition.

THE COMPETITION

Southern California’s leadership in electric-vehicle production is far from assured. In fact, the region faces extremely serious competition from the existing automobile industry. General Motors, Ford, Chrysler, Toyota, Nissan, Mitsubishi, Suzuki, Daihatsu, Peugeot, Fiat, Volkswagen, Mercedes Benz, and BMW all plan to bring a variety of electric vehicles to market in the near future. They are working on both conversions of gasoline-powered models and purpose built vehicles. Ironically, one major stimulus to the auto giants’ interest in electric vehicle technologies has been California’s strong statutory attack on air pollution: many have even targeted California as their primary market.

The major car producers have several established advantages over potential Southern California rivals. They have had long experience in building and managing large-scale production systems for vehicle manufacture. They have marketing expertise and distribution networks. They have both the legal and technical ability to deal with the maze of costly regulations governing vehicle safety in the United States. They have the engineering and financial resources to meet onerous front-end research and development costs. But one obstacle prevents them from making use of those advantages: very- few people want to buy an electric vehicle-yet.

BATTERIES AND THE MARKET

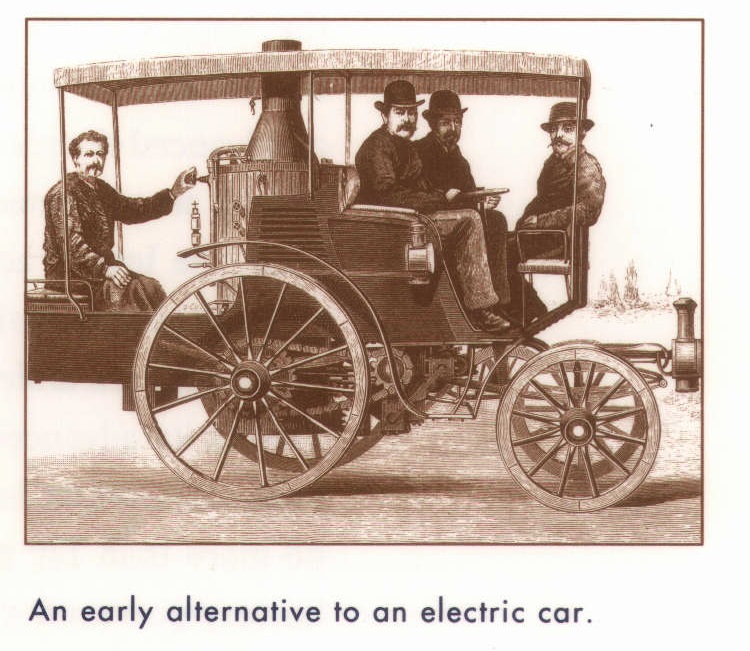

Right now, few consumers would buy an electric car because of the expense and inconvenience of running one. With current technologies, battery-powered cars can drive only 80 to 120 miles before dying, and a recharge takes up to 8 hours. Even with new technologies for a hybrid vehicle driven by both electricity and gasoline, the drawbacks imposed on the individual buyer are still great. Research being conducted on batteries in a wide variety of agencies and firms, such as US Advanced Battery Consortium, will certainly improve battery technology in the future. However, for the present, battery technology remains primitive. (See DeLuchi and Swan, p. 14, for an alternative to batteries.)

Without advanced battery technology, the private costs in terms of money and effort will continue to be higher for electric cars than for gasoline cars. But public interest in electric cars grows because gasoline cars are so polluting. The effects of air pollution on citizens’ health, quality of life, and even business viability have long concerned people in Los Angeles, the automobile capital of the nation. There is now great interest in the region, and in California at large, in aggressively attacking pollution by getting rid of its main cause: the gasoline engine. However, because people are not likely to switch to public transportation in huge numbers, policy-makers are looking at electric cars as a potential solution.

The California Air Resources Board now mandates that 2 percent of car-makers’ fleets in the state shall be composed of zero-emission vehicles (ZEVs) by 1998, 5 percent by 2001, and 10 percent by 2003. Other states have set similar targets. Thus, political leaders are forcing a market for electric vehicles. Eventually, as manufacturers improve their technologies, making electric cars perform better and cost less, a natural market will replace the politically created one. The stage at which every family wants an electric car, however, is still in the far future.

While electric-vehicle markets remain small, the massive scale advantages of the principal car producers cannot be brought fully into play. For the time being, the electric vehicle industry will consist of large numbers of small manufacturing operations producing limited batches of vehicles in designs liable to frequent alteration.

The fragmented nature of the industry provides California with its best opportunity. Even if Southern California could not in the long run compete in final vehicle assembly, it should nonetheless be able to build a very significant capacity in components and parts production. Indeed, CALSTART’s main goal is to concentrate on creating a components industry in the region that will supply major electric-vehicle assemblers in other parts of the world.

AN INFANT INDUSTRY

We are now observing in Southern California a classic instance of what product- cycle theorists call “the period of infancy,” when we typically find: (a) a small number of pioneer entrepreneurial firms; (b) industrial product and process configurations that are highly unstable and susceptible to rapid change; (c) considerable subcontracting activity in order to reduce in-house costs, as well as to enhance flexibility; (d) high levels of risk and a high probability of bankruptcy for many participants. Out of this initial period of ferment, the firms that find superior combinations of technology, management, and marketing strategies survive.

Intense inter-firm network relations that tend to occur in this early phase lead participants to locate in the same geographical region. This agglomeration produces a local labor market of trained specialists for the industry. It also offers possibilities for setting up institutional infrastructures that help to maintain advantages in technological improvement and innovation, labor training, information services, and just-in-time processing networks.

One of the major assets for electric-vehicle manufacturing in Southern California is significant public support for the industry. This support reduces the industry’s initial risks and hence improves its chances for shifting out of infancy and into a phase of substantial growth. However, the form that public policy should take poses some extraordinarily difficult questions.

RECOMMENDATIONS

Without attempting to specify the precise terms of actual policy actions and their institutional expressions, I would argue that public policy needs to encourage the following features in the industry and its milieu:

- Flexible production systems so that adaptations to rapidly changing technological and market conditions can be swiftly introduced.

- Collaborative inter-firm relations and joint-venture activities so that problems can be creatively resolved by pooling resources.

- Active transference of skills and technologies from the aerospace-defense industry into the electric-vehicle industry.

- Inclusion of many different firms and technologies in the policy-making process in order to allow for the possibility of unforeseen and unpredictable advances.

- Investment in basic infrastructural services and skills required by the industry (e.g., crash-testing facilities, training of electric-car technicians and repair personnel).

- Continued public investment in research and development for the industry, perhaps by making increased sums of money available to CALSTART or similar consortia.

- Intensified efforts to extend the market for electric vehicles (e.g., through tax rebates, parking privileges, reduced electricity prices, HOV lane privileges, recharging facilities away from home, increased taxes on gasoline).

There is a considerable role for governmental and other public agencies, private public consortia, industry associations, labor unions, citizens’ groups, and other in helping to accomplish tasks such as these. At the same time, a key piece of the puzzle is still missing from the emerging electric-vehicle industry in Southern California.

MAJOR MANUFACTURERS

What’s missing is direct participation by major vehicle manufacturers. Except for General Motors’ subcontracting of design and controller development tasks to AeroVironment and Hughes, respectively, no major automaker yet has contributed to the electric-vehicle industry in Southern California. However, as we have already seen, the major car manufacturers already have enormous acquired advantages in the development, production, and marketing of road vehicles.

A major boost to development of a South California industry could be achieved by combining in one local production complex (a) some representation from major car manufacturers with (b) continued initiatives for components development and systems engineering. I believe that state and local policy-makers should now be concentrating attention on attracting one or two major manufacturers (whether American, Japanese, or European) to Southern California to participate in and to enhance current developments.

A major boost to development of a South California industry could be achieved by combining in one local production complex (a) some representation from major car manufacturers with (b) continued initiatives for components development and systems engineering. I believe that state and local policy-makers should now be concentrating attention on attracting one or two major manufacturers (whether American, Japanese, or European) to Southern California to participate in and to enhance current developments.

At the outset they should aim to establish not major assembly facilities but small craft centers making vehicles in relatively small batches for limited markets. This might be accomplished by persuading companies already having design centers in the region to upgrade and broaden their local facilities. It would, of course, require material incentives of various sorts to attract major manufacturers to the region, but the time to act is now. Otherwise, electric-vehicle manufacturing industries may beign developing in other regions, and California could lose its early-mover advantage.

The big manufacturers, however, may be deterred by the bad press about California’s faltering economy. There is thus a need for careful documentation of the real advantages of a California location for the major producers. Among these are the possibilities of

- Tapping into significant local public support

- Local Access to the first major market for electric vehicles

- Participation in a multi-faceted industrial and technological effort involving creative interactions within the developing local supplier base.

If the ideal scenario of joining with the big auto manufacturers can be achieved, South California may well become a major growth pole for the electric-vehicle industry, producing a diversity of components and other inputs as well as assembled vehicles. With this capacity, the region might eventually be capable of serving not only local markets, but also markets in the rest of the country, if not the world. At the very least, the region will be a major center of innovative components and subsystems production for the industry worldwide.

Footnote:

- Morales, et al, 1991.

- Bell, 1992.

REFERENCES

L. Bell, “The Development of an EV Component Industry in California ” in Electric Vehicle Policy and Technology Conference Proceedings (Los Angeles: Joshua Newman and Associates and the Electric Vehicle Association of the Americas, 1992).

R. Morales, M. Storper, M . Clstemas, C. Quandt, A. J . Scott, J. Slifko, W. Thomas, M. Wachs, and S. Zakhor, Prospects for Alternative-Fuel Vehicle Use and Production In Southern California: Environmental Quality and Economic Development (University of California, Los Angeles: Lewis Center for Regional Policy Studies, Working Paper No. 2, 1991, price: $15.00).

A. J. Scott, ed., Electric Vehicle Manufacturing In Southern California: Current Developments, Future Prospects (University of California, Los Angeles: Lewis Center for Regional Policy Studies, Working Paper No. 5 , 1993, price: $15.00). UCTC No. 170.