Ever since the widespread adoption of automobiles, Americans have preferred to pay for highways and bridges with “user fees”—that is, money collected from those who use the roads. Tolls and fuel taxes, which are roughly proportional to travelers’ use of roads, have been the most common user fees. However, revenues from user fees have been falling for three decades, as legislators become ever more reluctant to raise them to meet inflation. It has been easier to try new kinds of fees, such as sales taxes, to pay for transportation infrastructure. In the guise of urgent solutions to immediate problems, seemingly modest local tax increases are setting a national trend. Without deliberating or consciously adopting a change in policy, indeed without much discussion at all, we are gradually devolving transportation finance back to local governments and reducing user fees. Without knowing it, we may be experiencing a revolution in transportation finance, and we haven’t stopped to ask whether this is good or bad.

Ever since the widespread adoption of automobiles, Americans have preferred to pay for highways and bridges with “user fees”—that is, money collected from those who use the roads. Tolls and fuel taxes, which are roughly proportional to travelers’ use of roads, have been the most common user fees. However, revenues from user fees have been falling for three decades, as legislators become ever more reluctant to raise them to meet inflation. It has been easier to try new kinds of fees, such as sales taxes, to pay for transportation infrastructure. In the guise of urgent solutions to immediate problems, seemingly modest local tax increases are setting a national trend. Without deliberating or consciously adopting a change in policy, indeed without much discussion at all, we are gradually devolving transportation finance back to local governments and reducing user fees. Without knowing it, we may be experiencing a revolution in transportation finance, and we haven’t stopped to ask whether this is good or bad.

A hundred years ago almost all roads were local facilities. Neighborhood streets and county roads have long been and still are the responsibility of local governments. Neighborhood streets carry a small proportion of traffic by volume, even though they make up most of the system’s lane miles. They are critically important because they provide access to residential and commercial properties. In addition to being essential to residents and employees, access imparts value to property by allowing service by postal trucks, fire engines, police cars, ambulances, trash collectors, plumbers, and others. Streets are also the most common channels for electric wires, gas mains, and water and sewer pipes. Local governments have long provided and maintained such roads, financing them primarily by levying taxes on the properties that benefit from them.

Eighty Years of User Fees

Over time, states assumed a different, complementary transportation mission. In the early part of the twentieth century, Americans wanted to get farmers out of the mud and connect them to regional markets. At the same time, rapid growth in automobile use created traffic jams on existing roads. Gradually, states augmented local roads by creating major routes designed for heavy longer-distance traffic. These arterials—the state highways—had to be paid for, which quickly strained state treasuries. In the early 1920s, California was devoting more than forty percent of all its revenue to building and maintaining roads and paying interest on bonds it had issued to build roads. Despite this spending, congestion was getting worse because appetites for road travel were growing.

mission. In the early part of the twentieth century, Americans wanted to get farmers out of the mud and connect them to regional markets. At the same time, rapid growth in automobile use created traffic jams on existing roads. Gradually, states augmented local roads by creating major routes designed for heavy longer-distance traffic. These arterials—the state highways—had to be paid for, which quickly strained state treasuries. In the early 1920s, California was devoting more than forty percent of all its revenue to building and maintaining roads and paying interest on bonds it had issued to build roads. Despite this spending, congestion was getting worse because appetites for road travel were growing.

From this financial exigency came the revolutionary concept of “user fees.” Because traffic on state roads imposed costs on the state roughly in proportion to its volume, it made sense to cover the costs of those roads by charging the users. While tolls were considered the fairest way to charge users, they had a major drawback. Toll booth construction and toll-collector wages absorbed so large a proportion of toll revenues that they were sometimes difficult to justify.

The first revolution in transportation finance came when states adopted user fees in the form of motor fuel taxes. Although they charged for road use in rough proportion to motorists’ travel, and heavier vehicles paid more because they used more fuel per mile of travel, fuel taxes didn’t quite match tolls for efficiency because they didn’t levy charges at the time and place of use. However, they cost much less to administer than tolls, so fuel taxes became the principal means of financing America’s main roads. Because they were user fees, most states reserved fuel taxes exclusively for transportation expenditures. When the federal government decided in 1956 to expand intercity highways on a national scale, it increased federal fuel taxes and created the Federal Highway Trust Fund, emulating the “user pays” principle that had been so successful in the states.

For eighty years, motor fuel taxes have paid most costs of building and operating major roads in the US. As public policy gradually came to favor a transportation system balanced between private cars and public transit, highway user fees also contributed to construction and operation of transit systems. But a major change is now underway, and most citizens are not even aware it is happening. Federal and state fuel taxes, though still the largest source of revenue for transportation, are rising much more slowly than travel volumes and transportation costs. They no longer cover the costs of building, operating, and maintaining the transportation system. And instead of raising fuel taxes or introducing electronic toll- collection systems, legislators are allowing local governments to raise funds locally even if not through user fees—thus changing the basis of transportation finance. Cities, counties, and transit districts are increasingly turning to “local option transportation taxes” to fund new transportation investments. The most visible examples of these in recent years have been voter-approved sales taxes funding particular roads and rail transit projects.

For eighty years, motor fuel taxes have paid most costs of building and operating major roads in the US. As public policy gradually came to favor a transportation system balanced between private cars and public transit, highway user fees also contributed to construction and operation of transit systems. But a major change is now underway, and most citizens are not even aware it is happening. Federal and state fuel taxes, though still the largest source of revenue for transportation, are rising much more slowly than travel volumes and transportation costs. They no longer cover the costs of building, operating, and maintaining the transportation system. And instead of raising fuel taxes or introducing electronic toll- collection systems, legislators are allowing local governments to raise funds locally even if not through user fees—thus changing the basis of transportation finance. Cities, counties, and transit districts are increasingly turning to “local option transportation taxes” to fund new transportation investments. The most visible examples of these in recent years have been voter-approved sales taxes funding particular roads and rail transit projects.

Shrinking Fuel Tax Revenues

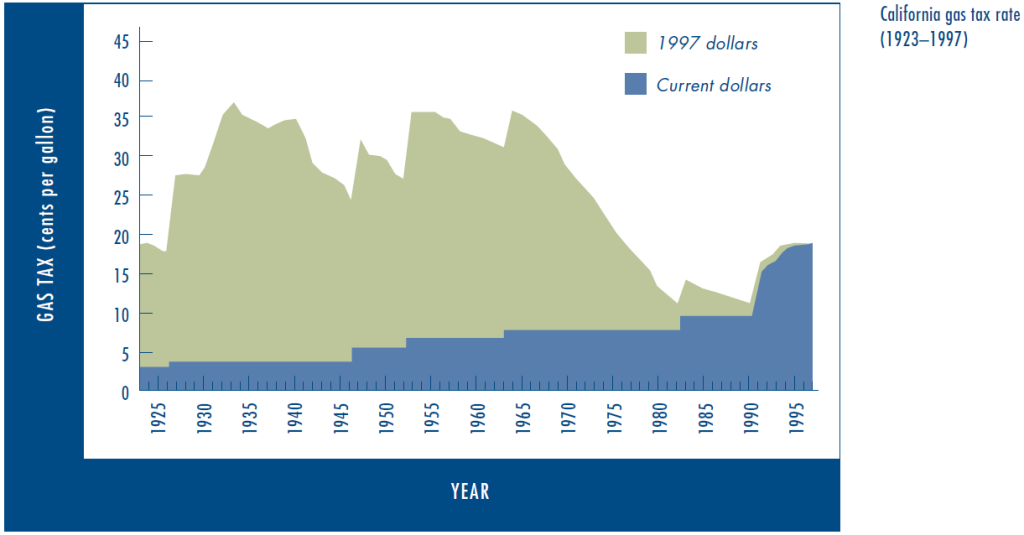

Fuel taxes are generally levied as a charge per gallon of fuel sold. They do not increase automatically when the cost of living rises, as do sales taxes and income taxes. Instead, they must be increased by acts of legislatures. These taxes were in the past enormously popular because many constituencies saw the benefits of transportation investments to be well worth their costs, but this is no longer true. Between 1947 and 1963 the California fuel tax was increased three times, as was the federal fuel tax; but then neither was raised for over twenty years. Since 1982 the California gas tax has been raised only once by the legislature and once again by popular vote when the governor refused to endorse a change without a referendum.

In 1957 the California fuel tax stood at 6 cents per gallon. If it had risen at the same rate as inflation, the state fuel tax would today be set at 32.5 cents per gallon. But it’s only 18 cents per gallon, or 14.5 cents below its 1957 buying power. California is not unique; on average, fuel taxes in the fifty states would have to rise about 11 cents per gallon to recoup their 1957 buying power.

While these figures are impressive enough, the situation is actually even worse. Overall new vehicle fuel consumption was about 14 miles per gallon in 1974, and today it stands at about 28 miles per gallon. While we collect fewer pennies per gallon, we drive twice as many miles per gallon—so, when measured per mile of driving, fuel tax revenues are plummeting dramatically.

Big Changes Underway

A surge in local ballot measures has been taking up the slack caused by the drop in fuel tax revenues at the state and federal levels. Before 1980, few states encouraged or even permitted their towns or counties to levy their own transportation fees, except for the property taxes traditionally used for neighborhood streets and county roads. In the ’70s, major metropolitan areas adopted permanent sales taxes to support the development of new transit systems; in the ’80s, several states authorized local jurisdictions to use ballot measures to raise revenues for transportation purposes. The pace accelerated during the ’90s as 21 states either adopted new laws authorizing local option transportation taxes or saw dramatic expansion in their use.

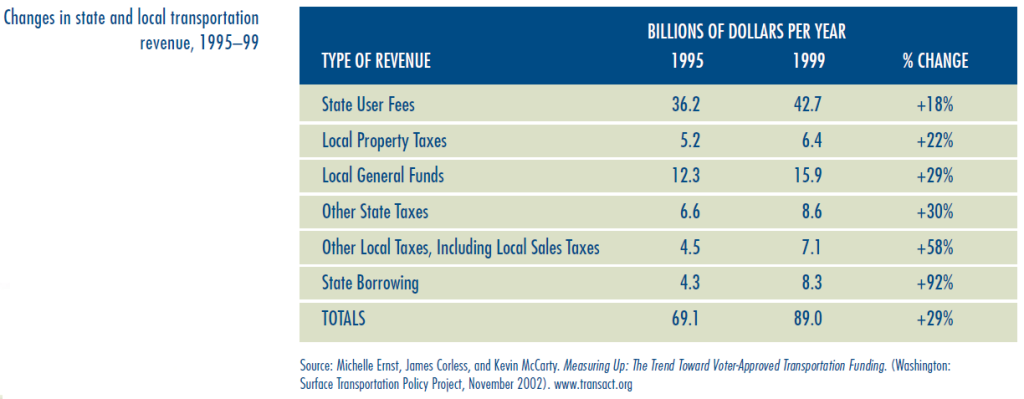

The accompanying table based on data assembled by the Surface Transportation Policy Project shows how dramatic the change has been in just a five-year period. While revenue from user fees increased by eighteen percent from 1995 through 1999, and is still the largest source of revenue, the growth rate in local transportation taxes was several times as great during this time period. Although “borrowing” money by issuing bonds grew at the fastest rate, it remains a small proportion of the total and is not really a source of revenue, since money from other sources is always needed to repay the principal and interest.

During calendar year 2002, American voters considered 44 separate ballot measures to raise money for transportation. Nine of them were state-wide elections, and only a few involved user fees like fuel taxes. Local sales taxes are by far most common in these measures, but some local governments have enacted vehicle registration fees (arguably a user fee, but more accurately a form of property taxation), taxes on real estate sales, local income or payroll taxes earmarked for transportation, and taxes on new real estate developments.

In California, residents of eighteen counties—containing eighty percent of the state’s population—have voted to raise their sales taxes to pay for county and city transportation improvements. Collectively, these measures are producing roughly $2 billion per year for capital investment in new highway and transit facilities and for maintenance and operation of existing ones. These sales taxes are the fastest growing source of money for transportation in California and in many other states.

The popularity of local sales taxes for transportation can be attributed to four important characteristics:

- Direct local voter approval: These measures typically result in projects and services near voters’ homes and work places, so they personally can appreciate them and anticipate their In an era of growing distrust of politicians, these measures provide tangible direct local benefits.

- The taxes have finite lives: Voters enact transportation taxes that will persist typically for fifteen or twenty years unless specifically reauthorized by another popular Voters thus have a sense of control over their money. If projects don’t live up to their expectations or if they fully accommodate growth and reduce congestion, the taxes could end.

- Specific lists of transportation projects: The taxes may be used only to build specific projects or fund specific programs, and politicians’ discretion to spend the money is severely

- Local control over revenues: The money raised locally is spent locally and for local benefit, under the control of a local transportation authority, assuring citizens that the money will not leak into other jurisdictions.

These provisions give citizens more direct control over the transportation investments they pay for than was typical with motor fuel taxes. Sales taxes are also lucrative because they have a broad base. While fuel taxes are paid only when we purchase a single commodity, sales taxes are paid by many more people when they purchase a wider range of goods. So a low tax rate can provide a lot of money. One county, for example, estimated that a one-percent general sales tax produces as much revenue as would a motor fuel tax of sixteen cents per gallon.

What Transportation Sales and Taxes are Supporting

County transportation sales taxes have supported a wide variety of projects, with a fairly even split among highways, local roads, and public transit. Measures adopted earlier generally earmarked revenue for specific projects listed on the ballot; later measures more frequently allocated funds for “program categories,” or less explicit groups of uses and projects.

The most consistent trend in sales-tax expenditures across all California counties shows operations and maintenance of existing facilities  receiving less funding than new capital projects. However, the content of expenditure plans varies widely from county to county and from measure to measure, reflecting differences in local priorities. Rural counties are more likely than urban ones to put control of sales tax revenues in the hands of local jurisdictions and to spend most of their revenues on highway projects, streets, and roads rather than transit.

receiving less funding than new capital projects. However, the content of expenditure plans varies widely from county to county and from measure to measure, reflecting differences in local priorities. Rural counties are more likely than urban ones to put control of sales tax revenues in the hands of local jurisdictions and to spend most of their revenues on highway projects, streets, and roads rather than transit.

Transportation Authorities

Each county that collects and administers a transportation sales tax has a designated transportation authority to oversee use of the funds. Transportation authorities build improvements themselves, rather than relying on the California Department of Transportation (Caltrans), and proponents cite this shift of authority from state to counties as a major benefit of county-level taxes. Transportation authorities typically claim a number of advantages over Caltrans in developing and delivering transportation projects, including greater sensitivity and flexibility in responding to local needs, less institutional inertia, and flexibility to pursue environmental review and design simultaneously rather than sequentially. The creation of county transportation authorities significantly reinforced planning and delivery of transportation improvements at the county level. But stronger county-level decision-making could be weakening the regional planning mandate of California’s multi-county metropolitan planning organizations. State and federal funds, for example, may be diverted to complement county projects, rather than spent on priorities of metropolitan planning organizations. Opportunities to plan regionally also suffer where a large proportion of sales tax revenue is returned directly to local jurisdictions within a county.

The earliest measures envisioned transportation authorities focusing solely on delivery of a few high-profile capital transportation projects, not on planning. Local transportation sales taxes have since evolved into a funding source to serve many ongoing transportation needs, including maintenance of local streets and roads, paratransit services, and transit operations. In California and elsewhere, transportation authorities are playing increasingly central roles in funding the ongoing operations of communities’ transportation systems. Because these authorities have evolved without oversight by state or metropolitan planning organizations, their governing boards consider themselves accountable solely to the county voters for implementing their expenditure plans. Integrating land use planning with county-level transportation planning, for instance, is not an explicit transportation authority goal or responsibility.

Limited Spending Flexibility

Supporters tout the benefits of enumerating specific projects in the ballot measures. But voters thereby limit the transportation agencies’ flexibility in responding to changes in conditions or needs during the life of the measures. All but five of California’s transportation sales taxes  earmark some amount of revenue for specific projects, limiting the power of transportation authorities to reset priorities once the tax has been approved. Even when funds are not earmarked for specific projects, the intended uses of revenue for specified program categories are constrained by ballot measures.

earmark some amount of revenue for specific projects, limiting the power of transportation authorities to reset priorities once the tax has been approved. Even when funds are not earmarked for specific projects, the intended uses of revenue for specified program categories are constrained by ballot measures.

Revenue shortfalls, cost escalations, or changing political sentiments about projects may mean that over time agencies will want to deviate from the list of voter-approved projects. Transportation authorities face pressure to expend funds in accordance with the ballot measures and to deliver on the commitments made by local political leaders regardless of changing budgets or shifting political priorities. This pressure can have serious drawbacks. There have proven to be many obstacles to the completion of projects administered by transportation authorities. And the transportation authorities are not required by ballot measures to base their implementation priorities on project cost-effectiveness, nor to spend sales tax revenues on mitigating potentially damaging environmental consequences.

Where Are Transportation Sales Taxes Taking Us?

Transportation tax referenda around the nation are often assumed to be nothing more than a new and politically expedient way of raising needed revenue; but they are doing much more than that. In addition to raising money, they are gradually but inexorably changing the way we finance transportation systems in four fundamental ways:

- The growing popularity of sales taxes is shifting the financial base of our transportation system from user fees to general taxes paid by all citizens, regardless of their direct reliance on the transportation Economists find that user fees have at least some tendency to induce more efficient use of the transportation system; higher fuel taxes might, for example, encourage motorists to acquire more fuel-efficient vehicles. In contrast, general taxes provide no incentive for greater transportation efficiency of any sort. And, while sales taxes and fuel

taxes are both regressive, the effects on the poor of user fees are tempered by the fact that those who pay them always benefit from them, while sales taxes burden non-users as well as users. When fuel taxes were adopted in the ’20s they were considered “second best” solutions; tolls were better but administratively complex. Today, we can lessen the problems associated with toll collection by implementing electronic systems like Fastrak or Easy Pass. Ironically, user fees are declining in favor of general taxes just as technology is making them more feasible.

taxes are both regressive, the effects on the poor of user fees are tempered by the fact that those who pay them always benefit from them, while sales taxes burden non-users as well as users. When fuel taxes were adopted in the ’20s they were considered “second best” solutions; tolls were better but administratively complex. Today, we can lessen the problems associated with toll collection by implementing electronic systems like Fastrak or Easy Pass. Ironically, user fees are declining in favor of general taxes just as technology is making them more feasible. - The rising use of county sales taxes and the growing role of metropolitan transportation planning are consistent with a national trend toward devolution, but federal policy and the rise of county tax measures are in fundamental While Congress and many states are devolving transportation decision making to the regional level by enhancing the powers of metropolitan planning organizations, county sales taxes can undermine the influence and authority of those groups by focusing resources and decision making on counties and other smaller units of government.

- Gradually, local taxes are increasingly limiting the transportation policymaking authority of elected officials by requiring that transportation funds be spent strictly in accordance with the language of the ballot measures over fairly long periods of And project lists are gradually eliminating the flexibility necessary to adapt to changing needs.

- While transportation planners and engineers often apply analytical procedures like benefit-cost analysis to determine which investments should be selected, ballot measures proposing local transportation taxes substitute election campaigns—sometimes called “beauty contests”—for Many believe that greater reliance should be placed on analysis of project cost effectiveness, but by listing popular projects in the sales tax measures, we are gradually limiting the relevance of systematic analysis in project selection. While local control and direct democracy are American ideals, it is probably not appropriate for voters to preempt the application of technical expertise in the design and management of transportation systems.

Most important, there has not yet been a national debate in which Americans or their elected representatives have deliberately considered the merits and drawbacks of these potentially enormous changes. Instead, a significant shift in national policy is occurring without public notice as one local measure is adopted after another. Drop by drop, we are creating a flood of change which may deservedly be called a second revolution in transportation finance.

Further Readings

Matthew Adams, Rachel Hiatt, Mary C. Hill, Ryan Russo, Martin Wachs, and Asha Weinstein. Financing Transportation in California: Strategies for Change (Institute of Transportation Studies, Research Report UCB- ITS-RR-2001-2, March 2001).

Jeffrey Ang-Olson, Martin Wachs, and Brian D. Taylor, “Variable-Rate State Gasoline Taxes,” Transportation Quarterly, vol. 54, no. 1, pp. 55–68, Winter 2000.

Jeffrey Brown, Michele Di Francia, Mary C. Hill, Philip Law, Jeffrey Olson, Brian D. Taylor, Martin Wachs, and Asha Weinstein. The Future of California Highway Finance (California Policy Research Center, University of California, 1999).

Todd Goldman and Martin Wachs, “A Quiet Revolution in Transportation Finance: The Rise of Local Option Transportation Taxes,” Transportation Quarterly, vol. 57, no. 1, pp. 19–32, Winter 2003.

Martin Wachs, “Fighting Traffic Congestion with Information Technology,” Issues in Science and Technology, vol. 19, no. 1, pp. 43–50, Fall 2002.