Introduction

Donald Shoup

ACCESS goes digital.

After publishing paper copies since its founding in 1992, and also publishing online since 1998, ACCESS will become entirely digital starting with this issue. Changes in readership have led to this change in format. During the past year, ACCESS had 191,000 page views from 122,000 readers in 70 countries, so we are eliminating the cost of paper and following our readers to where we now find them.

Subways, Strikes, and Slowdowns

Michael L. Anderson

Public transit receives a large share of transportation funds but accounts for only 1 percent of passenger miles traveled nationwide. Nevertheless, public transit subsidies remain popular in many areas. For example, in 2008, 67 percent of Los Angeles County voters approved a half-cent sales tax to raise $26 billion for transit over 30 years.

The Hidden Cost of Bundled Parking

C.J. Gabbe, Gregory Pierce

Urban renters in the US face fast-rising housing prices, especially in coastal metropolitan areas. Price increases are in part due to restrictive land-use regulations. Minimum off-street parking requirements, a central component of land-use regulation in the US, warrant detailed study and policy reform. In most cities today, municipal regulation requires developers to provide on-site parking. Renters or buyers then pay for this parking as part of their monthly rent or purchase price; the price of parking is thus “bundled” with the price of the housing unit. While many households might have chosen to pay for on-site parking in a free market, this proportion is surely lower than what has been mandated. Moreover, the historical effect of minimums and bundled parking hides a transportation cost burden in housing prices, leaving households unable to choose. Minimum parking requirements force developers to build costly parking spaces that drive up the price of housing. Urban policymakers have recently taken an interest in reforming parking regulations and allowing unbundled parking based on social equity and environmental sustainability rationales.

Is Travel Really That Bad?

Eric A. Morris

Okay, the title of this article is a bit tongue-in-cheek, but travel does involve considerable costs. The average household spends about $8,500 per year on transportation, making it one of our biggest expenditures. Time is another cost of travel, because the roughly hour and ten minutes American adults spend traveling each day might be better spent on things like work, family, and even sleep. Travel can also be tiring, stressful, dangerous, and more.

Ridesourcing’s Impact and Role in Urban Transportation

Susan Shaheen, Nelson Chan, Lisa Rayle

App-based, on-demand ride services—also known as Transportation Network Companies (TNCs)—have grown rapidly in recent years and caused debate in the passenger transportation industry. Advances in information and communication technology have enabled these services to provide a wide variety of real-time and demand-responsive trips. Companies such as Lyft, Uber, and Sidecar (now defunct) have developed smartphone apps whereby passengers can “source” a ride from a private passenger vehicle driven by a non-commercially licensed driver (usually). These apps communicate the passenger’s location to the driver via GPS and charge a distance-based fare. The driver is paid approximately 80 percent of the fare; the company keeps the rest. Many of these apps maintain a rating system that allows drivers and passengers to rate each other after the trip is completed. A passenger’s credit card information can be saved within the system to facilitate future trips.

Parking Benefit Districts in China

Donald Shoup, Quan Yuan, Xin Jiang

Many low-income neighborhoods have two serious problems: overcrowded on-street parking and undersupplied public services. One policy can address both problems: charge for on-street parking to manage demand and use the resulting revenue to finance local public services.

THE ACCESS ALMANAC: Traffic Congestion Is Counter-Intuitive, and Fixable

Brian D. Taylor

To live in Los Angeles is to endure chronic traffic congestion. Cities are places where people cluster together to create and enjoy the benefits of economic wealth, cultural vibrancy, intellectual exchange, and more. But with clustering comes traffic — often lots of it. While nearly everyone agrees that traffic is a problem, opinions diverge widely on what to do about it.

ACCESS 50, Special Issue: Transportation Finance

Introduction: Greatest Hits

Brian D. Taylor

Prior to the recent explosion of digital access to individual songs, greatest hits albums were a staple of the music industry. An artist with enough successful albums under his or her belt could repackage the best songs on each previous album into a greatest hits collection, which often then became a bestseller itself.

Here at ACCESS, we have more than a few successful issues under our collective belt, so many that our first greatest hits album even has a theme: Transportation Finance. While it was hard to narrow it down, the six articles we chose for this ACCESS Finance Special Issue collectively consider creative approaches emerging in California and elsewhere to address our mounting financial challenges in transportation.

From Fuel Taxes to Mileage Fees

Paul Sorensen

For much of the past century, federal and state taxes on gasoline and diesel have provided the majority of funding for US highway construction and maintenance. Fuel taxes perform well in this role: they distribute the tax burden among drivers in rough proportion to their use of the road network, are inexpensive to administer, and offer a modest incentive to buy and drive fuel-efficient vehicles.

Download the PDF.

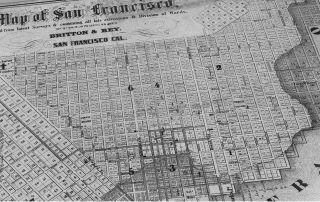

SFpark: Pricing Parking by Demand

Gregory Pierce and

Donald Shoup

In 2011, San Francisco adopted the biggest price reform for on-street parking since the invention of the parking meter in 1935. Most cities’ parking meters charge the same price all day, and some cities charge the same price everywhere. San Francisco’s meters, however, now vary the price of curb parking by location and time of day.

Download the PDF.

Just Road Pricing

Lisa Schweitzer and

Brian D. Taylor

Economists have long advocated road pricing as an efficient way to reduce congestion and improve the environment. Many critics, however, object to road pricing on the grounds that it unfairly burdens low-income drivers. Implicit in these objections is the idea that existing transportation finance methods burden the poor less, or at least spread the burden more fairly. Most of the equity concerns about road pricing stem from the fact that it is regressive; that is, poorer people spend a larger share of their incomes on tolls than do wealthier people. But in the US, road systems are financed primarily through fuel taxes, vehicle registration fees, property taxes, and, increasingly, sales taxes—all of which are also regressive. Thus the relevant question is not simply whether road pricing is regressive, or even if it will burden the poor. The relevant question is whether road pricing will burden the poor more than other ways of paying for roads.

For Whom The Road Tolls: The Politics Of Congestion Pricing

David King,

Michael Manville, and

Donald Shoup

It is almost universally acknowledged among transportation planners that congestion pricing is the best way, and perhaps the only way, to significantly reduce urban traffic congestion. Politically, however, congestion pricing has always been a tough sell. Most drivers don’t want to pay for roads that are currently free, and most elected officials—aware that drivers are voters—don’t support congestion pricing.

The Private Sector’s Role In Highway Finance: Lessons From SR 91

Marlon G. Boarnet and

Joseph F. DiMento

The gap between needed highway-construction funds and gasoline-tax revenues threatens to widen further. Hybrid vehicles are a reality; alternative fuels are on the horizon; and the gasoline tax—long the workhorse of highway finance in the United States—will inevitably decline in importance. So the search is on for new funds. Can the private sector help fill the gap?

Only a few privately financed highways have been built in the US in the past half century. Among them, California’s State Route 91 (SR 91) in Orange County stands out as one of the mature examples. It began as something of a public policy long shot. In 1989, when state legislators debated a bill to allow a limited number of private highway franchises, even the bill’s supporters doubted it had a real chance of passage.

Local Option Transportation Taxes: Devolution as Revolution

Martin Wachs

Ever since the widespread adoption of automobiles, Americans have preferred to pay for highways and bridges with “user fees”—that is, money collected from those who use the roads. Tolls and fuel taxes, which are roughly proportional to travelers’ use of roads, have been the most common user fees. However, revenues from user fees have been falling for three decades, as legislators become ever more reluctant to raise them to meet inflation. It has been easier to try new kinds of fees, such as sales taxes, to pay for transportation infrastructure. In the guise of urgent solutions to immediate problems, seemingly modest local tax increases are setting a national trend. Without deliberating or consciously adopting a change in policy, indeed without much discussion at all, we are gradually devolving transportation finance back to local governments and reducing user fees. Without knowing it, we may be experiencing a revolution in transportation finance, and we haven’t stopped to ask whether this is good or bad.

THE ACCESS ALMANAC: Transportation Finance

Martin Wachs

If you read about the future of transportation, you likely will be overwhelmed by a flood of contradictory good and bad news, especially in California.

The good news is that there is boundless promise of growth and change in personal mobility, mostly in the private sector. The current pace of innovation in transportation is faster and farther-reaching than at any time since the invention of the automobile. Automated vehicles are evolving rapidly, new apps are helping us find our way and lowering travel costs, social network transportation services are booming, and the hyperloop promises to increase future longer distance mobility. We are on the verge of blending new technologies to provide instant automated point-to-point mobility for people and goods.